With a majority of customers staying home due to the pandemic, alcoholic beverage shoppers are seeking bulk beverage buys from convenience stores. Multi-packs of hard seltzer or beer, and large boxes of wine are in high demand. But above all, hard seltzer shines as the star of the alcoholic beverage category as c-store customers seek ‘sessionable’ drinking options. In other words, refreshing beverages that are low in alcohol content, allowing several to be consumed in one drinking session or across multiple sessions.

With a majority of customers staying home due to the pandemic, alcoholic beverage shoppers are seeking bulk beverage buys from convenience stores. Multi-packs of hard seltzer or beer, and large boxes of wine are in high demand. But above all, hard seltzer shines as the star of the alcoholic beverage category as c-store customers seek ‘sessionable’ drinking options. In other words, refreshing beverages that are low in alcohol content, allowing several to be consumed in one drinking session or across multiple sessions.

Alcoholic beverage sales have been soaring during the pandemic, according to Kim Cuellar, category manager, beer and wine for OnCue Express, which operates 60 c-stores in Oklahoma, with plans to expand into Houston in November.

“It’s spurred a lot of growth,” Cuellar said. “It’s brought in a ton of traffic to our stores. We continue to grow year over year. We’re seeing record sales in terms of beer and wine and in terms of overall inside sales.”

United Pacific saw similar sales upticks as alcoholic beverage customers altered their buying preferences amid the pandemic.

“We’ve definitely seen a shift into larger pack sizes — basically to 12-packs and up, and people shifting to what we call ‘the comfort packages,’” said Kelsey Capellino, category manager of adult beverage for United Pacific, which operates 453 company-operated stores and 56 fee-operated locations. The company’s primary banners include We Got It, My Goods Market, Pump Eat Drink and Rocket.

Customers are gravitating toward brands they’re familiar with and beverages that are light, low-calorie and easy to drink — a far cry from the craft beer experimentation craze of the past few years, Capellino explained. “It’s the sessionability of these packages that people are looking for.”

While customers aren’t experimenting in the same way as usual during COVID-19, they are willing to pay a bit more for a premium beverage.

“We’ve cut down a bit on our promotional activity, and we didn’t see a decrease in traffic in our beer selection,” Capellino said. “Consumers, especially the younger generation, are understanding that by paying a bit more, you have a better liquid than you necessarily would bargain shopping.”

Meanwhile at OnCue, premiums and below premiums are down in terms of the total share of beer dollars, but super premiums are “on fire” — another sign customers are willing to spend a little more.

Cuellar also concurred that sessionability is driving purchase decisions.

“I would say the trend of the summer is sessionable,” she added. “Customers want to be able to drink all day and go into the evening. People want to be able to drink a little bit lower alcohol by volume and be able to make it last all day.”

Still, the growth in 12-pack and larger-size packs isn’t causing a dip in singles or smaller-pack purchases.

“We didn’t see a trade-up from singles — just incremental sales, and so it probably is attributed to more frequent shopping or new customers coming into our stores because of the ease of convenience,” Capellino said.

Seltzer Soars

Hard seltzer fits the trend of an easy-to-drink, light, low-calorie beverage, and its sales have been skyrocketing.

Hard seltzer is categorized as part of the flavored malt beverage (FMB) segment, but 60% of hard seltzer shoppers and 70% of millennial drinkers — the base hard seltzer buyer — consider it its own category, Nielsen reported. Fewer than 10% think hard seltzer is a type of beer.

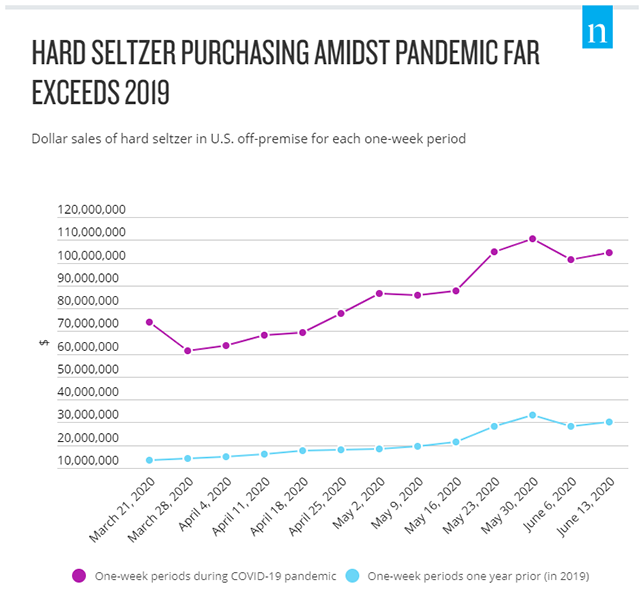

Hard seltzer off-premises sales in U.S. retail quadrupled on a year-over-year basis during the 15 weeks ending June 13, 2020 — an increase of $900 million, according to Nielsen. Total hard seltzer sales hit $2.7 billion for the 52 weeks ending June 13, 2020, with dollar share of total beer, FMB and cider surpassing 10% for four consecutive weeks, and more than twice the 4.4% share it held as of the 52 weeks ending Feb. 29, 2020. Nielsen predicted hard seltzer’s share of total beer sales will continue to grow.

“White Claw has been on fire,” Capellino said. United Pacific expanded its hard seltzer lineup at the beginning of the pandemic, adding Corona Hard Seltzers and Truly Lemonade Seltzer, as well as expanding its White Claw section and adding the 12-packs.

“We’ve encouraged stores, and we’ve been working with our distributors, to build ambient stacks of those items (12-packs) for holding capacity purposes,” she said.

Source: Nielsen Total U.S. off-premise measured channels, one-week periods from the week ending March 21, 2020 through the week ending June 13, 2020 (and the one-week periods in 2019 that occured one year prior); week of July 4, 2019.

“With the pandemic, customers want to be quick in and quick out, and they’re identifying with these brands that they know, not sitting there browsing. So as long as we have White Claw and Truly stacked on our floor and in our cooler, it’s a quick in and quick out for the consumer, and that’s why we have them keep coming back to us,” Capellino said.

OnCue is also seeing hard seltzer sales skyrocket.

“The hottest trend in the world right now is hard seltzers,” Cuellar said. “Right now, that’s making up a little over 7% of total beer dollars, which doesn’t sound like a lot, but that’s huge considering it was only about 1.5% last year.”

OnCue is also bringing in local seltzers. Import beers are usually a huge percentage of the chain’s total beer share, but COVID-19 has caused supply issues with some import brands specific to OnCue’s region.

With seltzers growing so fast, OnCue has been filling in any merchandising holes due to supply issues with hard seltzer, which has helped keep sales trending upward despite out-of-stocks on imports. “It seems no matter what seltzer I put in, it’s going to move,” Cuellar said.

Crafty Beer Sets

Pre-pandemic, Capellino planned to bring in a wide variety of craft selections playing on “hazy.”

“Hazy IPAs are different IPA-flavored beers (with fruity, citrus notes),” Capellino said. “Fruit beers are such a huge hit right now, especially with the millennial generation.”

Due to distribution uncertainty and not wanting to put the stores through the stress of a reset during the onset of a pandemic, it’s waiting to implement that set.

“I hope, once everything settles down, we can bring in more of that variety and beef up the craft selections for that consumer in months to come,” Capellino said. “But during the pandemic, we’re not necessarily seeing people purchase craft as frequently as pre-pandemic in what we had planned for in 2020.”

While national trends point to craft beer sales dipping, OnCue is going in the opposite direction and allocating more space to the craft segment.

“Because we’re a local company, we really are leaning in hard to support our local craft brewers because they’re being hit so hard by the pandemic,” Cuellar said. “We’ve also allocated a bunch of space to support them and to try to help their distribution. Our communities have really rallied around supporting local craft because we’re supporting it.”

Wine for the Win

Wine sales are also climbing at convenience stores during the pandemic.

United Pacific traditionally offers one shelf of wine, plus a section featuring wine Tetra Paks and take-home packages. It also introduced cans of wine about a year ago. But in the last few months, it has expanded its Tetra Pak section to support the demand for take-home packs of wine.

“We just deployed a new program for take-home wine with smaller Tetra Paks for the remainder of 2020 because we are seeing an uptick in wine, along with all of the other alcohol beverages,” Capellino said.

OnCue is seeing a similar demand for take-home packs of wine. “Three-liter boxes (of wine) are flying off the shelf,” Cuellar said.

OnCue features a large wine section, with most stores devoting at least 12 feet of space to the segment.

“We have some stores that have $60 bottles of wine. Every store pretty much has at least one $20 or $25 bottle offering,” she said.

The three-liter wine boxes were so popular, Cuellar recently added a special display rack to feature them. In the neighborhood stores specifically — as opposed to the chain’s interstate sites — three-liter boxes are in such high demand, it’s hard to keep them in stock. “They want something that’s going to last a long time,” she added.

Cuellar has also introduced wine-based, ready-to-drink cocktails, including margaritas. “Those are just on fire,” she said. “And then, Barefoot is coming out with wine-based seltzers that are really a lot smoother. They have a lot less bite than some of the hard seltzers.”

The demand for sessionable drinking options — and with it the hard seltzer trend — is likely to continue into fall.

“Customers want to be able to extend their drinking time,” Cuellar explained. “Even though people have fewer dollars, they’re trying to stretch their dollar as far as they can and wanting to have as much fun as they can for as long of a period as possible. That’s why we’re seeing all the 30-packs and the large-pack sizes selling more.”

The Link LonkSeptember 24, 2020 at 09:52PM

https://cstoredecisions.com/2020/09/24/hard-seltzer-sparkles/

Hard Seltzer Sparkles - CStore Decisions - Convenience Store Decisions

https://news.google.com/search?q=hard&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment