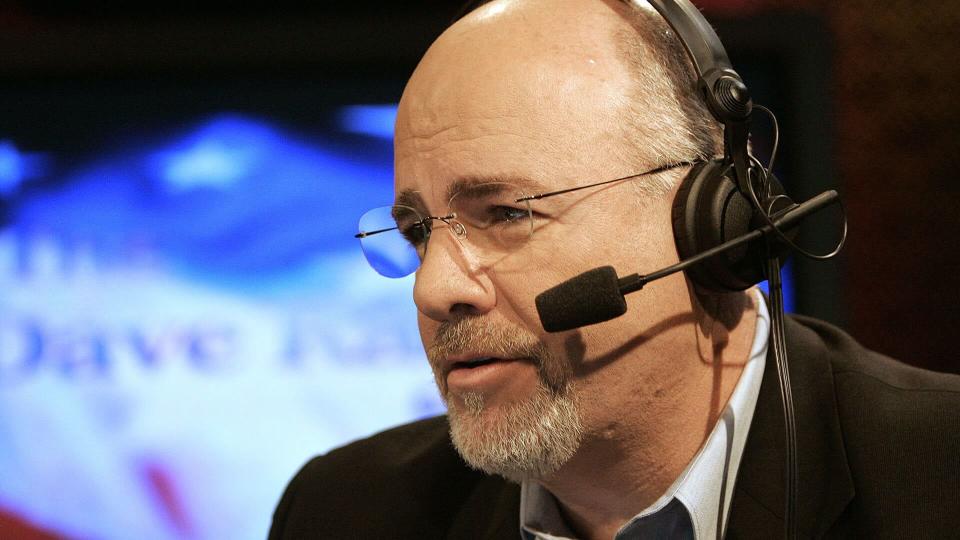

Should you pay off a mortgage or save money for a down payment on a new house? In a YouTube clip from “The Ramsey Show,” money expert Dave Ramsey shares his recommendation with a caller struggling with this dilemma.

The caller, Anthony, told Ramsey he and his wife recently became consumer debt-free and will have their emergency fund built up in the next two months. Anthony isn’t sure if it’s better to build equity in the existing mortgage or save up cash for a sizable down payment on a new home.

Which is more financially beneficial? Here’s why Ramsey recommends paying off your mortgage before saving another down payment.

‘Get Rich Slow’: Dave Ramsey Offers the Key to Lasting Wealth

Find Out: How To Build Generational Wealth From Scratch

‘Forced Savings Plan’

In the video, Ramsey said a guy he used to work with referred to paying extra on a mortgage as a forced savings account. Personally, Ramsey likes the forced aspect of this savings plan because you know you’ll stay on task.

“The weird thing about paying down your mortgage is it feels like the money’s gone, but it’s not,” said Ramsey. “It’s just saved in the equity because you get the money when you sell the house.”

The key is to trick yourself into as many smart money decisions as you can. Ramsey recommends the “automate smart and make stupid hard” approach. Because of all the autodrafts he has set up to automatically pay for bills, Ramsey said he hasn’t paid a utility bill in years.

Read More: Dave Ramsey Says ‘Money Is Not Just Math, It’s Behavior’ — 5 Bad Habits To Break Today

Tips for Paying Off Your Mortgage Early

You know you want to pay your mortgage off before saving money to buy a new house. What are some of the best ways to expedite this process? A blog post from Ramsey Solutions shares three approaches to quickly paying off your mortgage.

-

Making extra payments. If your mortgage company offers the ability to sign up for extra payments, you can use this opportunity to pay off your mortgage early. Ramsey Solutions recommends specifying that you want your extra payment applied to the mortgage’s principal balance. This ensures it goes toward paying off the balance instead of being used for next month’s payment.

-

Making your own lunch every day. Bringing your lunch to work might not be as fun as dining out but doing it every day helps you save a lot of money. As the post on Ramsey Solutions reads, in a situation where packing your lunch frees up $100 each month to put toward your mortgage and your mortgage is $220,000, you’ll be able to pay off your mortgage almost five years ahead of schedule.

-

Refinance. See if your existing home loan can be refinanced for a lower interest rate and a shorter term. Even though a short term means making a larger monthly payment, the post on Ramsey Solutions says it will be worth it if the amount fits in your housing budget.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: ‘Make Stupid Hard’ — Pay Off Your Mortgage Before Saving Another Down Payment

The Link LonkAugust 09, 2023 at 01:00AM

https://news.google.com/rss/articles/CBMiSWh0dHBzOi8vZmluYW5jZS55YWhvby5jb20vbmV3cy9kYXZlLXJhbXNleS1zdHVwaWQtaGFyZC1wYXktMTgwMDE3NTYxLmh0bWzSAVFodHRwczovL2ZpbmFuY2UueWFob28uY29tL2FtcGh0bWwvbmV3cy9kYXZlLXJhbXNleS1zdHVwaWQtaGFyZC1wYXktMTgwMDE3NTYxLmh0bWw?oc=5

Dave Ramsey: ‘Make Stupid Hard’ — Pay Off Your Mortgage Before Saving Another Down Payment - Yahoo Finance

https://news.google.com/search?q=hard&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment